UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

| | | | | | | | | | | |

| Filed by the Registrant | ý | Filed by a Party other than the Registrant | ¨ |

| | | | | | | | | | | | | | |

| Check the appropriate box: |

| | | |

| ¨ | | | Preliminary Proxy Statement |

| ¨ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | | Definitive Proxy Statement |

| ¨ | | | Definitive Additional Materials |

| ¨ | | | Soliciting Material Pursuant to §240.14a-12 |

| | | | |

| NORTHRIM BANCORP, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check all boxes that apply): |

| ý | | | No fee required. |

| ¨ | | | Fee paid previously with preliminary materials. |

| ¨ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

3111 C Street

Anchorage, AK 99503

April 18, 202316, 2024

Dear Shareholder:

I am pleased to invite you to attend the Northrim BanCorp, Inc. (the "Company") Annual Shareholders’ Meeting (the "Annual Meeting") where you will have the opportunity to hear about our 20222023 operations and our plans for 2023.2024. The Annual Meeting will be on Thursday, May 25, 2023,23, 2024, at 9 A.M. Alaska Daylight Time. The Annual Meeting will be a completely “virtual meeting" of shareholders. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions during the live webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/NRIM2023.NRIM2024. You will need to have your 16-Digit Control Number included on your Notice or proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting. Please keep your 16-Digit Control Number in a safe place so it is available to you for the Annual Meeting.

You will find additional information concerning the Company and our operations in the enclosed 20222023 Annual Report and Form 10-K, which includes our audited financial statements for the year ended December 31, 2022.2023.

Your opinion and your vote are very important to us. Please sign and return your proxy card, which is included with this document, as soon as possible. If you choose to attend the Annual Meeting online, voting by proxy will not prevent you from voting electronically; however, if you are unable to attend online, voting by proxy will ensure that your vote is counted.

Thank you for your continued support of the Company. If you have any questions, please feel free to contact the Corporate Secretary at (907) 562-0062.

Sincerely,

Joseph M. Schierhorn

Chairman Chief Executive Officer, President & Chief Operating Officer

NOTICE OF ANNUAL SHAREHOLDERS’ MEETING

To Be Held Online at www.virtualshareholdermeeting.com/NRIM2023NRIM2024 on May 25, 202323, 2024

Notice is hereby given that Northrim BanCorp, Inc. (the "Company") will hold its 20232024 Annual Shareholders’ Meeting (the "Annual Meeting") at 9 A.M. Alaska Daylight Time, on Thursday, May 25, 202323, 2024 at www.virtualshareholdermeeting.com/NRIM2023.NRIM2024. The Annual Meeting will be a completely “virtual meeting" of shareholders. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions during the live webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/NRIM2023.NRIM2024. You will need to have your 16-Digit Control Number included on your Notice or proxy card (if you received a printed copy of the proxy materials) to participate in the Annual Meeting. The Annual Meeting will be held for the following purposes, as more fully described in the accompanying proxy statement:

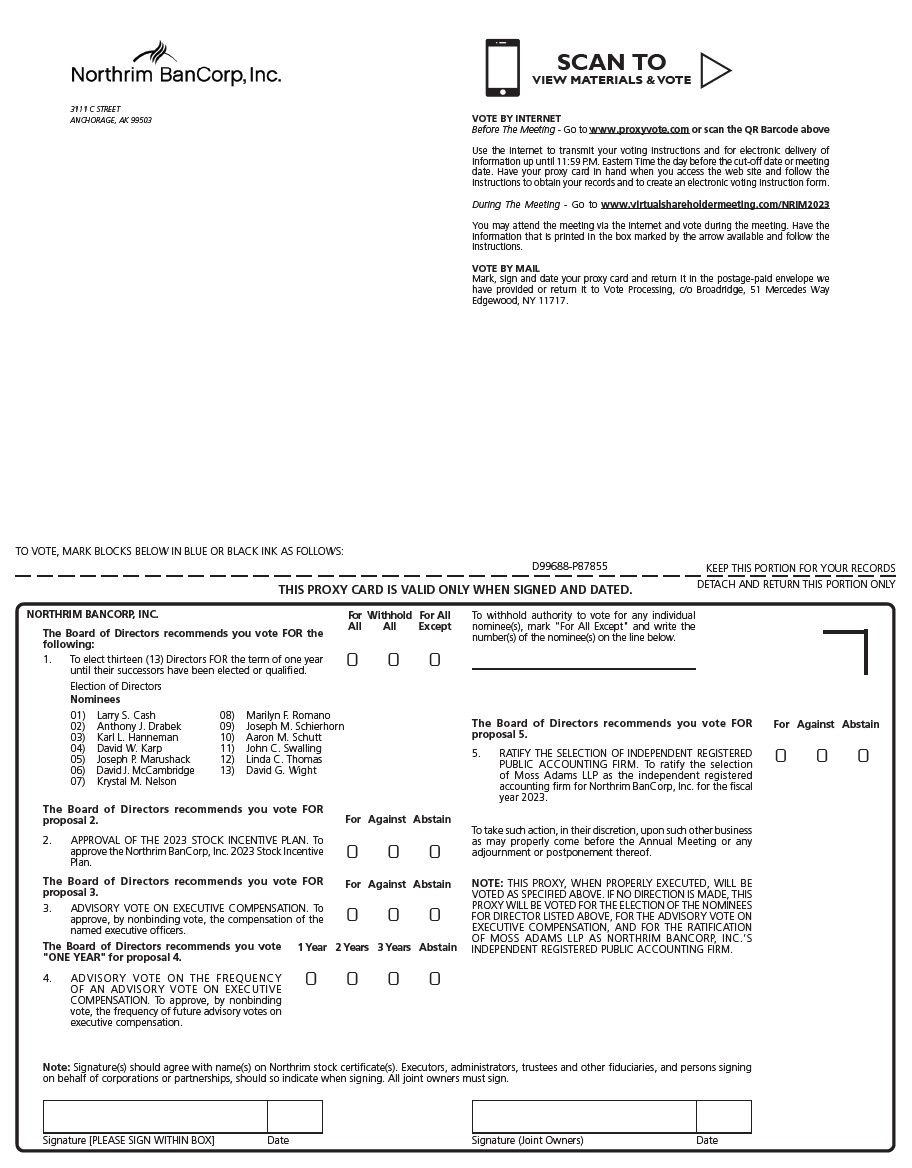

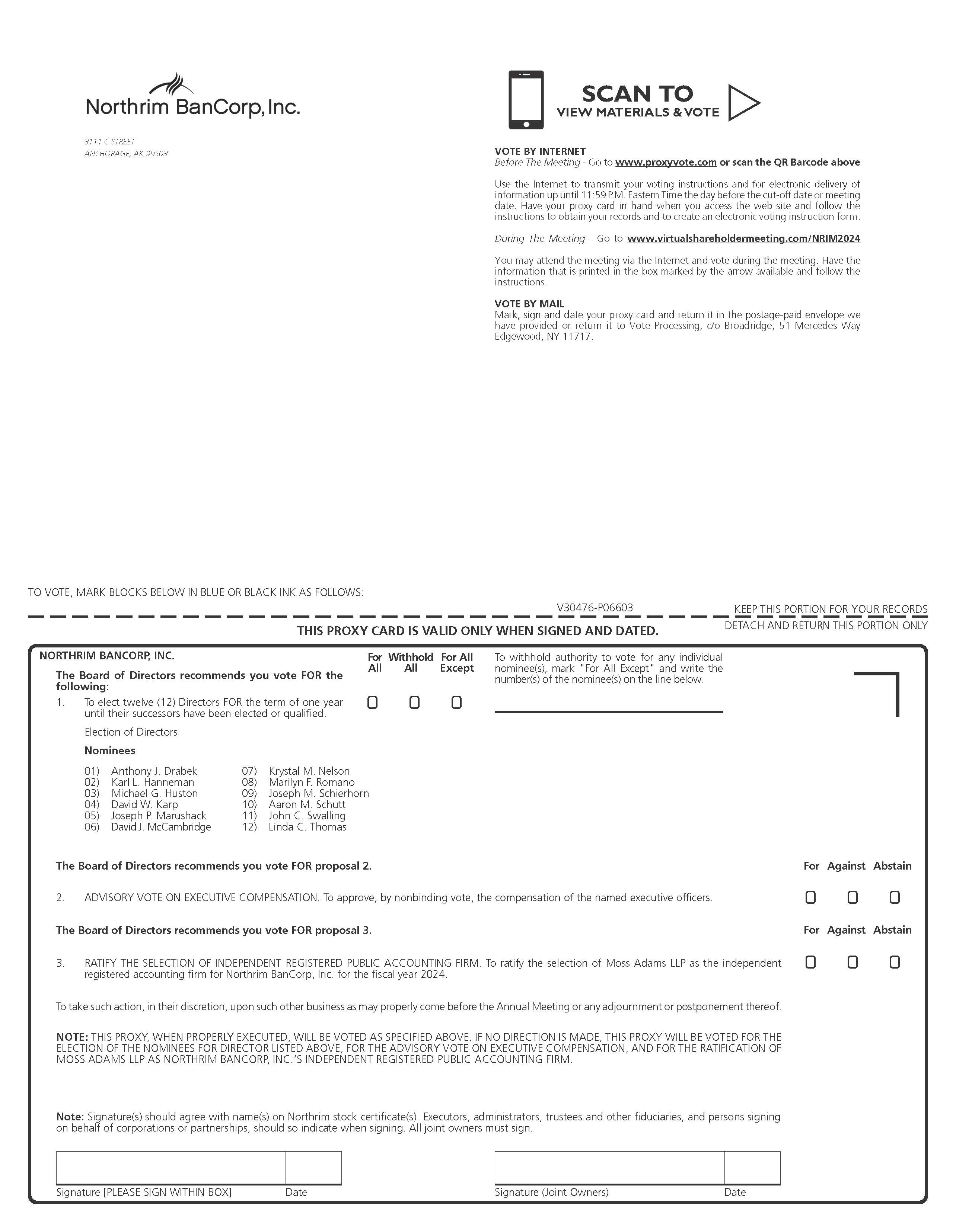

1) To elect thirteentwelve directors nominated by the Company's Board of Directors (the "Board") for a term ending at the 20242025 Annual Meeting or such other date as their successors may be elected and qualified;

2) To approve, the Company's 2023 Stock Incentive Plan;

3) To approve, by nonbinding vote, the compensation of the named executive officers as disclosed in these materials;

4) To approve, by non-binding vote, the frequency of future advisory votes on executive compensation;

5)3) To ratify the selection of Moss Adams LLP as the Company’s independent registered public accounting firm for fiscal year 2023;2024; and

6)4) To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

Shareholders owning the Company's shares of common stock at the close of business on March 31, 202328, 2024 are entitled to receive notice of and to vote online during the Annual Meeting or any adjournment or postponement of that meeting.

The Board recommends that shareholders vote "FOR" the slate of nominees to the Board outlined in this proxy statement; "FOR" approval of the Company's 2023 Stock Incentive Plan; "FOR" the approval of the compensation of the Company's named executive officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure in this proxy statement; "FOR" approval of the frequency of "every year" for future advisory votes on executive compensation; and "FOR" the ratification of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year 2023.2024.

By order of the Board of Directors,

/s/ Stefan Saldanha

Stefan Saldanha

Corporate Secretary

April 18, 202316, 2024

Whether or not you plan to attend the Annual Meeting online, please complete, sign and date the enclosed form of proxy and mail it promptly in the enclosed return envelope, which requires no postage if mailed in the United States. Alternatively, you may vote using the Internet by following the instructions described in the enclosed proxy statement. Your vote is important to us. If you participate in the Annual Meeting online, you may vote your shares online if you wish to do so even if you have previously sent in your proxy.

TABLE OF CONTENTS

| | | | | |

| |

| Solicitation, Voting, and Revocability of Proxies | |

| |

| Q & A about Voting and the Annual Shareholder’s Meeting | |

| |

| Proposal 1: Election of Directors | |

| |

| Executive Officers | |

| |

| Compensation Discussion and Analysis | |

| |

| Executive Compensation | |

| |

| Director Compensation | |

| |

| |

| |

| Interest of Management in Certain Transactions | |

| |

| Security Ownership of Certain Beneficial Owners and Management | |

| |

| Relationship with the Independent Registered Public Accounting Firm | |

| |

| Committee Reports | |

| |

| |

| |

Proposal 2: Approval of the 2023 Stock Incentive Plan | |

| |

Proposal 3: Advisory Vote on Executive Compensation | |

| |

| |

| |

Proposal 4: Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation | |

| |

Proposal 5:3: Ratification of the Independent Registered Public Accounting Firm | |

| |

| Information Concerning Shareholder Proposals | |

| |

| Householding | |

| |

20222023 Report to Shareholders and Annual Report on Form 10-K | |

| |

| Other Matters | |

| |

| Exhibit A: Audit Committee Charter | |

| |

| Exhibit B: Compensation Committee Charter | |

| |

| Exhibit C: Governance and Nominating Committee Charter | |

NORTHRIM BANCORP, INC.

3111 C Street

Anchorage, Alaska 99503

PROXY STATEMENT

The Board is soliciting proxies for this year’s Annual Meeting. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

The Board set March 31, 2023,28, 2024, as the record date for the Annual Meeting. Shareholders who owned the Company’s common stock on that date are entitled to vote online during the Annual Meeting, with each share entitled to one vote. There were 5,672,8415,499,578 shares of the Company's common stock outstanding as of the record date.

Voting materials, which include this proxy statement dated April 18, 2023,16, 2024, a proxy card, the 20222023 Annual Report and the Company’s Annual Report on Form 10-K, are first being mailed to shareholders on or about April 18, 2023,16, 2024, unless the shareholder has elected electronic delivery. If the shareholder has elected electronic delivery, we have provided a notice of Internet availability of proxy materials which contains instructions on how to access proxy materials via the Internet or how to request a printed set of proxy materials. Additionally, this Proxy Statement, the 20222023 Annual Report and the Company's Annual Report on Form 10-K are available at www.northrim.com by clicking the "Investor Relations" link. In accordance with Securities and Exchange Commission rules, our proxy materials posted on both our website and the website described below do not contain any cookies or other tracking features.

INTERNET AVAILABILITY OF PROXY MATERIALS

*****IMPORTANT NOTICE*****

Regarding the Availability of Proxy Materials for the Annual Shareholders’ Meeting

To be Held Online at www.virtualshareholdermeeting.com/NRIM2023NRIM2024 on May 25, 202323, 2024

Securities and Exchange Commission rules allow us to furnish proxy materials to our shareholders over the internet.

The Proxy Statement and Annual Report to Shareholders are available at

www.proxyvote.com

QUESTIONS AND ANSWERS ABOUT VOTING AND THE ANNUAL SHAREHOLDERS’ MEETING

Why is the Annual Meeting being held online?

As permitted by the Company’s Bylaws, as amended (the "Bylaws"), we will utilize the virtual meeting format for the Annual Meeting in order to facilitate and increase shareholder attendance and participation by enabling shareholders to participate fully and equally from any location around the world, at no cost. We believe that the use of the virtual annual meeting format is the right choice for the Company under the circumstances, as it not only brings cost savings to the Company and our shareholders, but also increases our ability to engage with all shareholders, regardless of their size, resources, or physical location. We view the virtual meeting format as consistent with our commitment to shareholder engagement as one of our tools by which to further reach our shareholder base. A virtual meeting is also environmentally friendly and in line with our commitment to sustainable business practices.

We remain sensitive to concerns regarding virtual meetings generally from investor advisory groups and other shareholder rights advocates who have voiced concerns that virtual meetings may diminish shareholder voice or reduce accountability. Our Bylaws provide that our annual meetings may be held virtually, by means of remote communication, and our virtual shareholder meeting guidelines provide that (i) we implement reasonable measures to verify that each person deemed present and permitted to vote at the meeting is a shareholder or proxy holder, (ii) we implement reasonable measures to provide shareholders and proxy holders a reasonable opportunity to participate in the meeting and to vote on matters submitted to shareholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with such proceedings, and (iii) we maintain a record of any votes or other action taken by shareholders or proxy holders at the meeting. Accordingly, the procedures for our virtual meeting format comply with these requirements, and in fact, we believe that our format enhances, rather than constrains, shareholder access, participation and communication. For example, the online format allows shareholders to communicate with us during the meeting so they can ask appropriate questions of our Board or management in accordance with the rules of conduct for the meeting. A further description regarding this process can be found under “Questions and Answers About Voting and the Annual Shareholders’ Meeting - How Do I Attend and Participate in the Annual Meeting.” During the live Q&A session of the meeting, we will answer questions as they come in, as time permits.

See “Questions and Answers About Voting and the Annual Shareholders’ Meeting - How Do I Attend and Participate in the Annual Meeting” in this proxy statement for more information regarding this year’s virtual Annual Meeting. In addition, information regarding the ability of shareholders to ask questions during the Annual Meeting, related rules of conduct at the Annual Meeting, and procedures for posting appropriate questions received during the Annual Meeting, will be available on our website at www.northrim.com under "Investor Relations." Similarly, matters addressing technical and logistical issues, including technical support during the Annual Meeting and related to accessing the Annual Meeting’s virtual meeting platform, will be available at www.virtualshareholdermeeting.com/NRIM2023.NRIM2024.

Why am I receiving this proxy statement and proxy card?

You are receiving this proxy statement and proxy card because you own shares of the Company’s common stock. This proxy statement describes matters on which we would like you to vote on at the Annual Meeting.

When you sign the proxy card, you appoint the persons named in the proxy, Messrs. Joseph M. SchierhornMichael G. Huston and Jed W. Ballard, as your representatives at the Annual Meeting, and those persons will vote your shares at the Annual Meeting as you have instructed on the proxy card. This way, your shares will be voted even if you cannot attend the Annual Meeting online.

Who is soliciting my proxy, and who is paying the cost of solicitation?

The enclosed proxy is solicited by and on behalf of the Board, and the Company will bear the costs of solicitation. Certain directors, officers, and employees of the Company and/or its subsidiary, Northrim Bank (the "Bank"), may solicit proxies by telephone, facsimile, the Internet, and personal contact.

The Company does not expect to pay any compensation to employees, officers, or directors for soliciting proxies, but will reimburse brokers, nominees, and similar record holders for reasonable expenses in mailing proxy materials to beneficial owners of the Company’s common stock.

How do I attend and participate in the Annual Meeting?

Our completely virtual Annual Meeting will be conducted on the internet via live audio webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/NRIM2023.NRIM2024. You also will be able to vote your shares online during the Annual Meeting.

All shareholders of record as of March 31, 2023,28, 2024, or their duly appointed proxies, may participate in the Annual Meeting. To participate in the Annual Meeting, you will need the 16-Digit Control Number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting webcast will begin promptly at 9:00 A.M. Alaska Daylight Time. We encourage you to access the meeting prior to the start time. Online access will begin at 8:45 A.M. Alaska Daylight Time.

The virtual meeting platform is fully supported across browsers and devices running the most updated version of applicable software and plugins. Participants should ensure that they have a robust internet connection wherever they intend to participate in the Annual Meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

If you choose to vote your shares online during the Annual Meeting, please follow the instructions provided on the Notice to log in to www.virtualshareholdermeeting.com/NRIM2023.NRIM2024. You will need the 16-Digit Control Number included on your Notice, on your proxy card, or on the instructions that accompanied your proxy materials.

Even if you plan to participate in the Annual Meeting, the Company strongly recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. Voting promptly will save us the expense of further requests for proxies in order to ensure a quorum at the Annual Meeting.

Shareholders may submit questions during the Annual Meeting. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/NRIM2023,NRIM2024, type your question into the “Ask a Question” field, and click “Submit.”

Questions pertinent to meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding matters irrelevant to the Company’s business, material non-public information, related to threatened or ongoing litigation, repetitious statements, or personal matters, are not pertinent to meeting matters and therefore will not be answered.

What if I experience technical difficulties with attending the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log inlogin page.

What am I voting on, and what vote is required for approval?

At the Annual Meeting, you will be asked to vote on:

● the election of thirteentwelve directors to serve on the Board until the 20242025 Annual Meeting or until their successors have been elected and have qualified ("Proposal 1");

● approval of the Northrim BanCorp 2023 Stock incentive Plan ("Proposal 2");

● a non-binding advisory vote on the compensation of the named executive officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure in this proxy statement ("Proposal 3");

● a non-binding advisory vote for the approval of the frequency of "one year" for future advisory votes on executive compensation ("Proposal 4"2"); and,

● the ratification of Moss Adams LLP as the Company’s independent registered public accounting firm for fiscal year 20232024 ("Proposal 5"3").

All proposals will require the affirmative vote of a majority of the Company's shareholders online or represented by a duly executed proxy at the Annual Meeting.

Who is entitled to vote?

Only shareholders who owned the Company’s common stock as of the close of business on the record date, March 31, 2023,28, 2024, are entitled to receive notice of the Annual Meeting and to vote the shares online that they held on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. Shares may be voted online or by submitting an executed proxy card to the Company.

How do I vote, and how are the votes counted?

Registered shareholders may vote online during the Annual Meeting, on the Internet, or by mail.

● Voting Online during the Annual Meeting. If you attend the Annual Meeting online, you may vote as instructed at the Annual Meeting. However, if you hold your shares in street name (that is, through a broker/dealer or other nominee), you will need to have with you during the Annual Meeting a proxy delivered to you by such nominee reflecting your share ownership as of the record date and your 16-Digit Control Number.

● Voting on the Internet. Go to www.proxyvote.com and follow the instructions. You will need your proxy when you access the website.

● Voting by Mail. Complete, date, sign, and mail the proxy in the enclosed postage pre-paid envelope. If you mark your voting instructions on the proxy, your shares will be voted at the Annual Meeting as you instruct. Please see the proxy for voting instructions.

If you own your shares through a brokerage account or in other nominee form, you should follow the instructions you receive from the record holder to see which voting methods are available. If your shares are registered in your own name and you attend the Annual Meeting online, you may vote online during the Annual Meeting, prior to the vote being closed. "Street name" shareholders, that is, those shareholders whose shares are held in the name of and through a broker or other nominee, who wish to vote online during the Annual Meeting will need to obtain a proxy from the broker or nominee that holds their shares. Your broker or nominee will generally provide you with the appropriate forms at the time you receive this proxy statement, including your 16-Digit Control Number. If you own your shares through a broker or other nominee, you cannot vote online during the Annual Meeting unless you receive a proxy card, including a 16-Digit Control Number, from the broker or nominee.

Each shareholder will be entitled to one vote for each share of common stock held of record by the shareholder on the record date, March 31, 2023.28, 2024. With regard to the election of directors, you may cast your vote in favor of some or all of the nominees, or you may withhold your vote for any nominee in the election of directors. Withheld votes will be excluded entirely from the vote and will have no effect on the outcome. On other proposals, you can "abstain." If you abstain, your shares will be counted as present at the Annual Meeting for purposes of that proposal and your abstention will have the effect of a vote against the proposal. Shareholders may not cumulate their votes for the election of directors.directors, i.e. it is not permitted to vote your shares twelve times for a single director.

If your shares are held in street name, the broker or nominee is permitted to exercise voting discretion under certain circumstances. At the Annual Meeting, if the broker or nominee is not given specific voting instructions, the shares may not be voted on Proposal 1 Proposal 2, Proposal 3, or Proposal 42 by the broker or nominee in their own discretion, and the votes will be "broker non-votes," which will have the effect of excluding your vote from the tallies. However, in these cases, and in cases where the shareholder abstains from voting on a matter, those shares will be counted for determining whether a quorum is present. We expect that brokers or nominees will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions with respect to Proposal 53 to ratify the Company’s selected independent registered public accounting firm, but abstentions will have the effect of a vote against the Proposal 5.3.

If your shares are held of record in your own name and you do not vote, your shares will not be voted.

What does it mean if I receive more than one proxy card?

It means that you hold shares in multiple accounts. Please complete and return all proxies (either by mail or over the Internet) to ensure that your shares are all voted in accordance with your instructions.

Can I change my vote after I return my proxy card?

Yes. If the enclosed proxy is duly executed and received in time for the Annual Meeting, the persons named in the proxy will vote the shares represented by the proxy "FOR" the thirteentwelve nominees listed in the proxy statement, "FOR" the approval of the Company's 2023 Stock Incentive Plan, "FOR" the approval of the compensation of the named executive officers, "FOR" the approval of the frequency of "every year" for future advisory votes on executive compensation, and "FOR" the ratification of the Company’s independent registered public accounting firm. If you grant a proxy, you may revoke it at any time before its exercise by submitting a second proxy with a subsequent date either over the Internet or by mail to the attention of the Corporate Secretary at P.O. Box 241489, Anchorage, AK 99524-1489 or by announcing your revocation to the Corporate Secretary online during the Annual Meeting prior to the taking of a shareholder vote. The shares represented by properly executed proxies that are not revoked will be voted in accordance with the specifications in such proxies.

Can I vote on other matters or submit a proposal to be considered at the Annual Meeting?

The Company has not received timely notice of any shareholder proposals to be considered at the Annual Meeting, and shareholders may submit matters for a vote only in accordance with the Bylaws. The Board does not presently know of any other matters to be brought before the Annual Meeting.

For shareholders seeking to include proposals in the proxy materials for the 20242025 Annual Meeting, including nominations for director candidates, the proposing shareholder or shareholders must comply with our Bylaws, all applicable regulations, including Rule 14a-8 and Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the "1934 Act"), and the proposals must be received by the Corporate Secretary of the Company on or before January 26, 2024.24, 2025. Upon receipt of such proposal, the Company will determine whether to include the proposal in its proxy materials for the 20242025 Annual Meeting in accordance with the Bylaws and applicable law. Shareholders who intend to solicit proxies in support of director nominees other than the Company's nominees under Rule 14a-19 of the 1934 Act must comply with the requirements of the Company's Bylaws, including providing the notice required under Rule 14a-19 by January 26, 202424, 2025 and complying with the requirements of Rule 14a-19 and Section 2.2 of the Company's Bylaws. The Company will disregard any proxies solicited for a shareholder's director nominees if such shareholder fails to comply with such requirements. Shareholder proposals should be sent to the attention of the Corporate Secretary, Northrim BanCorp, Inc., P.O. Box 241489, Anchorage, AK 99524-1489. A further description regarding this process can be found under "Information Concerning Shareholder Proposals and Director Nominations."

How many votes are needed to hold the Annual Meeting?

A majority of the Company’s outstanding shares as of the record date (a quorum) must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. Shares are counted as present at the Annual Meeting if a shareholder is online and votes online during the Annual Meeting or has properly submitted an executed proxy card either over the Internet or by mail. Broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting. As of March 31, 2023,28, 2024, the record date for the Annual Meeting, 5,672,8415,499,578 shares of the Company’s common stock were outstanding and eligible to vote.

How many shares are owned by the Directors and Executive Officers?

All directors and named executive officers of the Company as a group (comprised of 1715 individuals) beneficially held 229,068228,463 shares of the Company's common stock as of March 31, 2023,28, 2024, representing 4.0%approximately 4.1% of the outstanding common stock of the Company.

Where and when will I be able to find the results of the voting?

The results of the voting will be announced at the Annual Meeting. Final results will be disclosed in the Company’s Current Report on Form 8-K to be filed with the Securities and Exchange Commission within four business days after the conclusion of the Annual Meeting.

How do I communicate with Directors?

The Board provides a process for shareholders to send communications to the Board or any of the individual directors. Shareholders may send communications to the Board or any of the directors at c/o Corporate Secretary, Northrim BanCorp, Inc., P.O. Box 241489, Anchorage, AK 99524-1489. All communications will be compiled by the Corporate Secretary of the Company and submitted to the Board or the individual directors on a periodic basis.

PROPOSAL 1: ELECTION OF DIRECTORS

General Information

How many directors are nominated?

The Company’s Articles of Incorporation provide that the Board will consist of not less than five nor more than twenty-five directors. Currently, the Board consists of thirteentwelve directors, and the Board has set the number of directors to be elected at the Annual Meeting at thirteen.twelve.

Who are the nominees?

The Board has nominated the individuals listed on the following pages for election as directors for a one year term expiring at the 20242025 Annual Meeting or until their successors have been elected and qualified. If any nominee declines or becomes unable to serve as a director before the Annual Meeting, the Board will select a replacement nominee, and your proxies will be voted for that replacement nominee. The Board presently has no knowledge that any nominee will decline or be unable to serve.

It is the Company’s policy to encourage director nominees up for election at the Annual Meeting to attend the Annual Meeting. All directors up for election at the 20232024 Annual Meeting attended the 20222023 Annual Meeting with the exception of Director Schutt who was excused from the meeting and Director Romano who was not a director in 2022.Meeting.

Information about the Nominees

The following table provides certain information about the nominees for director, including age, principal occupation(s), and public company directorships held during the past five years, and year first elected a director of the Company. All of the nominees are presently directors of the Company and the Bank.Bank, except for Mr. Huston. There are no family relationships among any of our current directors, director nominees, or executive officers. All of the nominees, with the exception of MessrsMessrs. Schierhorn, Huston, and Schutt, are deemed by the Board to be independent within the meaning of currently applicable rules of the Securities and Exchange Commission and the Nasdaq Global Select Market listing requirements.

| | | | | | | | | | | |

| Name/Age | Occupation of Nominee During Past Five Years |

Larry S. Cash, 71

Director Since: 1995

| Since 2020 | | Chair, RIM Architects, LLC (Alaska, California, Guam and Hawaii) |

2017 to 2020 | | Chief Executive Officer, RIM Architects, LLC (Alaska, California, Guam and Hawaii) |

1986 to 2016 | | President of RIM Architects, LLC |

| | | |

Anthony J. Drabek,, 75 76

Director Since: 1991 | Since 2019 | | Director, Koniag, Inc., an Alaska Native Corporation |

1989 to 2010

| | President and Chief Executive Officer, Natives of Kodiak, Inc., an Alaska Native Corporation |

| 2001 to 2010 | | President, Koncor Forest Products Co. |

| 1986 to 2010 | | Chairman, Koncor Forest Products Co. |

| | | |

Karl L. Hanneman,, 65 66

Director Since: 2014 | Since 2020 | | Director, Gatos Silver, Inc. |

| Since 2018 | | Director, International Tower Hill Mines, Ltd. (An advanced exploration(A development stage mining company.)(1) |

| Since 2017 | | Chief Executive Officer, International Tower Hill Mines, Ltd.(1) |

| 2018 to 2020 | | Director, Sunshine Silver Mining & Refining Corp. |

2015 to 20162017 | | Alaska Chief Operating Officer, International Tower Hill Mines, Ltd. |

| 2010 to 2015 | | Alaska General Manager, International Tower Hill Mines, Ltd. |

| 2010 to 2020 | | Director, Fairbanks Chamber of Commerce |

| 2008 to 2010 | | Director of Corporate Affairs, Teck Resources, Ltd. (A mining and mineral development company.) |

| Since 2011 | | Director, Usibelli Coal Mine, Inc. |

| Since 1997 | | Director, Alaska Mining Hall of Fame |

| Since 1998 | | Director, Resource Development Council |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| Name/Age | Occupation of Nominee During Past Five Years |

| Michael G. Huston, 56 | Since April 2024 | | President, Chief Executive Officer and Chief Operating Officer of the Company and President and Chief Executive Officer of the Bank. |

2023 to April 2024 | | President of the Bank |

| Since 2023 | | Vice Chair of Board, Housing Alaskans, A Public Private Partnership (HAPPP) |

| 2022 to 2023 | | President, Chief Lending Officer of the Bank |

| 2017 to 2023 | | Board Member, Anchorage Economic Development Corporation |

| 2017 to 2022 | | Executive Vice President, Chief Lending Officer of the Bank |

| 2012 to 2015 | | Executive Vice President, Chief Banking Officer, First Interstate Banc System |

| | | |

David W. Karp,, 56 57

Director Since: 2015 | Since 2022 | | Chairman, Community Advisory Board, Alaska Communications Systems Group, Inc. |

| Since 2020 | | Director, Resource Development Council |

| Since 2020 | | Board Member, KEEP Alaska Competitive |

| Since 2020 | | Board Member, Anchorage Economic Development Corp. |

| Since 2019 | | Senior Vice President & Managing Director, Alaska, Saltchuk |

| Since 2019 | | Board Member, Alaska Resource Education |

| 2018 to 2021 | | Chairman, Alaska Communications Systems Group, Inc. (A publicly traded company.) |

| 2011 to 2021 | | Board Member, Alaska Communications Systems Group, Inc. (A publicly traded company.company during some of that period.) Member, Nominating and Corporate Governance Committee |

| 2011 to 2018 | | President and Chief Executive Officer, Northern Aviation Services, Inc. |

| 2007 to 2018 | | President and Chief Executive Officer, Northern Air Cargo, Inc. |

| | | |

Joseph P. Marushack,, 64 65

Director Since: 2021 | 2023 to Present | | Director, McDermott International, LTD |

| 2015 to 2022 | | Board Member, Yellowstone Forever |

| 2015 to 2021 | | President, ConocoPhillips Alaska |

| 2012 to 2015 | | President, ConocoPhillips Asia, Pacific and Middle East |

| 2010 to 2012 | | President, ConocoPhillips Canada |

| 2007 to 2010 | | President, ConocoPhillips Australia |

| | | |

David J. McCambridge,, 67 68

Director Since: 2011 | 1999 to 2020 | | President and Director, Alaska Kidney Foundation (nonprofit) |

| 1978 to 2010 | | Audit Partner, KPMG LLP |

| 1985 to 2015 | | Treasurer and Director, The Tanaka Foundation |

| 1993 to 2012 | | Director, Great Alaska Council, Boy Scouts of America |

| | | |

Krystal M. Nelson,, 50 51

Director Since: 2015 | Since 2014 | | Chief Operating Officer, and Executive Vice President, Bering Straits Native Corporation, an Alaska Native Corporation |

| Since 2022 | | Board Member, Resource Development Council |

| Since 2020 | | Co-Chair, Trinity College Parents Leadership Council |

| 2014 to 2017 | | Trustee, Pacific Northern Academy Board |

| 2007 to 2014 | | Vice President and Chief Operating Officer, Ahtna Engineering Services |

| | | |

Marilyn F. Romano,, 62 63

Director Since: 2023 | Since 2011 | | Regional Vice President, Alaska Airlines |

| 2000-2011 | | Vice President/Publisher, Fairbanks Daily News-Miner |

| Since 2015 | | Board Member, Governor's Aviation Advisory Board |

| Since 2011 | | Vice President, Alaska Airlines Foundation |

| 2012-2021 | | Trustee, University of Alaska |

| 2012-2021 | | Chairperson, Anchorage Economic Development Corporation |

| | | |

| | | |

| | | | | | | | | | | |

| Name/Age | Occupation of Nominee During Past Five Years |

| 2012-2021 | | Board Member, Anchorage Economic Development Corporation (Chairperson 2017) |

| | | |

| | | |

Joseph M. Schierhorn,, 65 66

Director Since: 2016 | Since 2018 | | Chair, the Company and the Bank Board |

| Since 2017 | | President and Chief Executive Officer, the Company |

Since 2020 | | Co-Chair, KEEP Alaska Competitive |

2016 to 2019 | | Member, Federal Reserve Bank of San Francisco's Twelfth District Community Depository Institutions Advisory Council |

Since 2017 | | Lead Director and Audit Committee Chair, Pacific Wealth Advisors, LLC and Director, Pacific Portfolio Trust Co. |

Since 2016 | | Chief Executive Officer, the Bank |

2015 to 2022 | | President, the Bank |

Since 2013 | | Chief Operating Officer, the Company |

2013 to 2015 | | Corporate Secretary, the Company and the Bank |

2013 to 2014 | | Chief Operating Officer, the Bank |

Since 2017 | | Member, Board of Directors of the Pacific Bankers Management Institute Representing the Pacific Coast Banking School |

| Since 2020 | | Co-Chair, KEEP Alaska Competitive |

| 2017 to April 2024 | | President and Chief Executive Officer, the Company |

| 2016 to April 2024 | | Chief Executive Officer, the Bank |

| 2013 to April 2024 | | Chief Operating Officer, the Company |

| 2015 to 2022 | | President, the Bank |

| 2016 to 2019 | | Member, Federal Reserve Bank of San Francisco's Twelfth District Community Depository Institutions Advisory Council |

| 2013 to 2015 | | Corporate Secretary, the Company and the Bank |

| 2013 to 2014 | | Chief Operating Officer, the Bank |

| 2005 to 2017 | | Executive Vice President, the Company |

| 2005 to 2014 | | Executive Vice President, the Bank |

| 2001 to 2014 | | Chief Financial Officer, the Company and the Bank |

| | | |

Aaron M. Schutt,, 50 51 Director Since: 2018 | Since 2011 | | President and Chief Executive Officer, Doyon Limited, (anan Alaska Native Corporation)Corporation |

| Since 2018 | | Chair, Akeela, Inc. |

| Since 2018 | | Chair, ANCSA Regional Association |

| Since 2021 | | Member, University of Alaska Fairbanks Advisory Board |

| 2012 to 2019 | | Director and Vice President, Alaska Native Heritage Center |

| Since 2011 | | Director, ANCSA Regional Association |

| 2008 to 2011 | | Chief Operating Officer, Doyon Limited |

| Since 2007 | | Board of Managers, Doyon Utilities, LLC |

| 2006 to 2011 | | Senior Vice President, Doyon Limited |

| Since 2001 | | Director, Akeela, Inc. |

| | | |

John C. Swalling,, 73 74

Director Since: 2002 | Since 2018 | | Director and Treasurer, Ted Stevens Foundation |

Since 20052006 | | President and Director, Civic Ventures |

| Since 2001 | | Director, Alaska Pacific University Foundation |

| Since 1990 | | President and Director, Anchorage Museum Foundation |

| Since 1986 | | Board Member, Visit Anchorage |

| 1991 to 2019 | | President and Director, Swalling & Associates PC |

| 1975 to 2018 | | Director, Swalling Construction Co., IncInc. |

| Since 1974 | | Member, American Institute of CPAs |

| Since 1974 | | Member and past-President, Alaska Society of CPAs |

| 1994 to 2017 | | Director, DFK International |

| 1985 to 2020 | | Board Member (and former Chair), Providence St. Joseph Health Alaska Community Ministry Board |

| | | |

Linda C. Thomas, 69

Director Since: 2014

| Since 2016 | | Chief Executive Officer, Alaskan Brewing Company |

Since 2021 | | Board Member, League of Women Voters |

1996 to 2016 | | Chief Operations Officer, Alaskan Brewing Company |

1994 to 1996 | | Chief Financial Officer, Alaskan Brewing Company |

2013 to 2019 | | Director, Juneau Chamber of Commerce |

2007 to 2019 | | Director, Bartlett Regional Hospital |

| | | |

| | | | | | | | | | | |

| Name/Age | Occupation of Nominee During Past Five Years |

David G. Wight, 82

Linda C. Thomas, 70

Director Since: 2006 | Since 20182014 | | Board Member, The Dome (a non-profit company) |

| Since 2016 | | Director, Alaska Gasline Development CorporationChief Executive Officer, Alaskan Brewing & Bottling Co. |

Since 20142021 | | Unpaid Insider/consultant, Saturn FerrestolBoard Member, League of Women Voters |

20061996 to 20102016 | | Chief Operations Officer, Alaskan Brewing & Bottling Co. |

| 1994 to 1996 | | Chief Financial Officer, Alaskan Brewing & Bottling Co. |

| 2013 to 2019 | | Director, Storm Cat Energy (Denver based company)Juneau Chamber of Commerce |

Since 20022007 to 2019 | | Board Member, CommonWealth NorthDirector, Bartlett Regional Hospital |

| 2000 to 2005 | | President and Chief Executive Officer, Alyeska Pipeline Service Company

| 1992 to 2000 | President, BP Amoco Energy Co. Trinidad and Tobago |

| | | |

(1) Effective March 12, 2018, Karl Hanneman entered into a new employment agreement with International Tower Hill Mines Ltd. that states that Mr. Hanneman continues to be responsible for all duties normally incidental to the position of CEO. However, it reduces his salary by 50% due to a 50% reduction in the amount of time required to perform those duties as the scope of work for International Tower Hill Mines, Ltd. Mr. Hanneman is performing is reduced.

Board Composition: The following Board members Diversity Matrix provides a high-level overview of certain personal characteristics and backgrounds of directors serving as of the date of this proxy statement.director nominees.

| | Board Diversity Matrix | Board Diversity Matrix | Board Diversity Matrix |

| Number of Directors | Number of Directors | 13 | Number of Directors | 12 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Female | | | Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | Part I: Gender Identity | |

| Directors | Directors | 3 | 10 | — |

| Directors | |

| Directors | | 3 | 9 | — |

| Part II: Demographic Background | Part II: Demographic Background | |

| African American or Black | |

| African American or Black | |

| African American or Black | African American or Black | — | — |

| Alaskan Native or Native American | Alaskan Native or Native American | — | 2 | — | Alaskan Native or Native American | — | 2 | — |

| Asian | Asian | — | Asian | — |

| Hispanic or Latinx | Hispanic or Latinx | — | Hispanic or Latinx | — |

| Native Hawaiian or Pacific Islander | Native Hawaiian or Pacific Islander | — | Native Hawaiian or Pacific Islander | — |

| White | White | 3 | 8 | — | White | 3 | 7 | — |

| Two or More Races or Ethnicities | Two or More Races or Ethnicities | — | Two or More Races or Ethnicities | — |

| LGBTQ+ | LGBTQ+ | — | LGBTQ+ | — |

| Did Not Disclose Demographic Background | Did Not Disclose Demographic Background | — | Did Not Disclose Demographic Background | — |

Director Qualifications and Experience: The following table identifies the experience, qualifications, attributes, and skills that the Board considered in making its decision to appoint and nominate directors to our Board. The nominees' breadth and diversity of experience, mix of qualifications, attributes and skills strengthen our Board's effective oversight of the Company's business. While our longer tenured directors bring a wealth of experience and deep understanding of the business and local community in which we operate, we recognize the need for fresh perspectives, have consistently added new directors, and are committed to continued board and committee diversity and refreshment. This information supplements the biographical information provided above.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specific skills/knowledge: | | | | | |

| Professional standing in chosen field | Expertise in financial services or related industry | Community involvement | Other Board experience | Other public company experience | Accounting | Legal | Business management |

Larry S. Cash | x | | x | x | | | | x |

| Anthony J. Drabek | x | | x | x | | | | x |

| Karl L. Hanneman | x | | x | x | x | | | x |

| Michael G. Huston | x | x | x | x | x | | | x |

| David W. Karp | x | | x | x | x | | | x |

| David J. McCambridge | x | x | x | x | x | x | | x |

| Joseph P. Marushack | x | | x | x | x | | | x |

| Krystal M. Nelson | x | | x | x | | | | x |

| Marilyn F. Romano | x | | x | x | x | | | x |

| Joseph M. Schierhorn | x | x | x | x | | x | x | x |

| Aaron M. Schutt | x | | x | x | | | x | x |

| John C. Swalling | x | x | x | x | | x | | x |

| Linda C. Thomas | x | x | x | x | x | x | | x |

David G. Wight | x | | x | x | x | | | x |

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THESE NOMINEES.

Shareholder Nominations for 20232024 Annual Shareholders’ Meeting

In accordance with the Bylaws, shareholder nominations for the 20232024 Annual Meeting may be made (i) by, or at the direction of, a majority of the Board or (ii) by any shareholder entitled to vote online during the Annual Meeting, provided that such

shareholder has complied with the notice procedures set forth in the Bylaws and with the requirements of the 1934 Act (including

(including Rule 14a-19 and any Securities and Exchange Commission staff interpretations thereunder). Only persons nominated in accordance with the procedures set forth in the Bylaws shall be eligible for election as directors at the Annual Meeting. Nominations, other than those made by or at the direction of the Board, shall be made pursuant to timely notice in writing to the Corporate Secretary of the Company as set forth in the Bylaws. To be timely, a shareholder's notice shall be delivered to, or mailed and received at, the principal office of the Company not later than one-hundred-twenty days prior to the anniversary date of the immediately preceding annual meeting of shareholders of the Company.

Such shareholder’s notice shall set forth the information required in Section 2.2 of the Bylaws (a copy of which will be provided to any shareholder upon written request to the Corporate Secretary), including, but not limited to: (i) the proposing shareholder's timely written notice; (ii) such other information regarding the proposing shareholder, each nominee proposed by such shareholder and any other person as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission, or is otherwise required under Regulation 14A; (iii) the consent of each nominee to serve as a director of the Company if so elected; and (iv) a written questionnaire with respect to the background and qualifications of the nominee, completed and executed by the nominee, in the form required by the Company (which form suchthe proposing shareholder giving notice shall request in writing from the Corporate Secretary of the Company prior to submitting notice and which the Corporate Secretary shall provide to the proposing shareholder within ten days after receiving such request). The Company may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director of the Company or that could be material to a reasonable shareholder’s understanding of the independence, or lack thereof, of such nominee. With respect to solicitations under Rule 14a-19, reasonable evidence, including shareholder’s certification, that it has met the requirements of Rule 14a-19(a)(2) and Rule 14a-19(a)(3). If any proposing shareholder making a solicitation under Rule 14a-19 subsequently fails to comply with the requirements of Rule 14a-19(a)(2) or Rule 14a-19(a)(3) the nomination of each such proposed nominee shall be disregarded, notwithstanding that proxies or votes in respect of the election of such proposed nominees may have been received by the Company (which proxies and votes shall be disregarded).

The Board may reject any nomination by a shareholder not timely made in accordance with the requirements of the Bylaws and the requirements of the federal securities laws, regulations and rules, including Rule 14a-19, and each nominee must also meet all additional qualifications for directors which may be adopted from time to time by the Board or the shareholders or as set forth in the Governance and Nominating Committee Charter.

Information Regarding the Board of Directors and Its Committees

The Board has determined that all nominees other than MessrsMessrs. Schierhorn, Huston, and Schutt are independent within the meaning of currently applicable rules of the Securities and Exchange Commission and the Nasdaq Global Select Market listing requirements. The Company Board of Directors met nineseven times during 20222023 and the Bank Board of Directors also met nineseven times during 2022.2023, including a special meeting for Board specific training. The Board has adopted certain standing committees, including an Audit Committee, a Compensation Committee, and a Governance and Nominating Committee. During 2022,2023, all directors attended at least seventy-five percent (75%) of the total meetings of the Board and committee meetings that they were each required to attend. The Board did not hold any special meetings related to the novel coronavirus 19 ("COVID-19"). COVID-19 matters were addressed in regularly scheduled meetings of the Company and the Bank Boards and committee meetings.

Currently, the Board has determined that having the Company's Chief Executive Officer also serve as Chair of the Board is in the best interests of the Company's shareholders. Given Mr. Schierhorn's in-depth knowledge of the Company's business, his leadership in formulating and implementing strategic initiatives and the current regulatory and market environment, the Board believes that having one leader serving as both Chair and Chief Executive Officer provides the most decisive and effective leadership for the Company. Further, having a combined Chair and Chief Executive Officer enables the Company to speak with a unified voice to the Company's shareholders, employees, governmental and regulatory agencies, and other stakeholders. The Board believes that this current structure is optimal for the Company because it provides the Company with consistent leadership.

The Board has also designated one of its independent members as an independent lead director. Mr. John C. Swalling currently serves as the Company’s independent lead director. The independent lead director’s primary responsibilities are to preside over executive sessions of non-management directors; to conduct annual interviews with all directors regarding each director’s own self-assessment of their contribution to the Board prior to nominations for election at the Annual Meeting; and, to recommend to the Governance and Nominating Committee, in consultation with the Chair of the Board, proposed committee assignments and chairmanships. The Board believes that our leadership structure in 2023 of combining the Chair and Chief Executive Officer roles as part of a governance structure that includes an independent lead director, plus the exercise of key board oversight responsibilities by independent directors, is appropriate for the Company at this time. The structure of separating the Chair and the Chief Executive Officer roles in 2024 is anticipated to continue during the transition of Mr. Schierhorn's and Mr. Huston's roles.

Risk Oversight

The Company and the Bank have in place policies and procedures to manage risks that could affect their operational and strategic position as a profitable, safe and sound financial institution. The Bank’s Internal Audit Department provides written results of internal and out-sourced audits, including review of the credit quality of the loan portfolio, directly to the Audit Committee and management. The Audit Committee, which is made up entirely of directors deemed independent of the Company by the Board, reviews, and reports to the Board on the results of these audits. The Audit Committee also reports to the Board on any deficiencies identified, as well as any steps deemed necessary to resolve and mitigate risk. An officer, appointed by the Board, serves as the Bank’s risk manager and is responsible for monitoring and maintaining the Bank’s

company-wide contingency plan. This contingency plan addresses and provides guidelines for the restoration of business in the event of man-made and natural disruptive events.

The Company monitors its interest rate risk through a review of its sensitivity to upward and downward movements of interest rates and their impact on the Company’s interest-earning assets, interest-bearing liabilities, and the net interest margin. The Company monitors concentrations and economic trends in the communities it serves and in the global economy in order to respond to issues that could affect the economic climate in which it operates. The Company's management reports its analysis of these areas to the Bank’s Board of Directors on a periodic basis.

It is management’s policy to discuss a detailed analysis of any proposed major project with the Board. This analysis generally includes management’s reasons for the proposal, results of due diligence analysis, potential risks, costs, and the estimated period for implementation of the project, and the Bank's Compliance Department and Operations and Technology Committee's recommendations prior to seeking the Board’s approval.

From time to time, the Company provides director education and discussion as to bank directorship issues, the management of risk, miscellaneous timely topics affecting the Company, as well as future corporate governance matters by receiving periodic briefings from senior management of the Company, legal counsel, auditors and other consultants. In addition, the Company periodically engages the services of experienced consultants to facilitate more formal director education matters, strategic planning, and other topics affecting the Company.

Cybersecurity and Information Security Risk Oversight

Management of cybersecurity risk is the responsibility of the full Board, with additional assistance from the Audit Committee and the Governance and Nominating Committee.With regard to certain cybersecurity and information security risks affecting the Company and the Bank, we recognize that not maintaining the privacy and security of customer information could damage our reputation and cause us to incur additional costs or even litigation. The Board also devotes significant time and attention to the oversight of cybersecurity and information security risk and receives an operational risk update that includes a review of cybersecurity and information security risk. The Governance and Nominating Committee periodically reviews and reassesses the Company’s cybersecurity oversight framework and initiatives. As part of its oversight of cybersecurity and informational security risk, on an annual basis, the Bank’sour Board of Directors reviews its Information Security Policy with its appointed Information Security Officer and frequently receives presentations on and discusses cybersecurity and information security risks, industry trends and best practices.practices from our Chief Information Officer and our Information Security Officer..

We workThe Company continuously monitors its information systems to educate our customers aboutproactively assess, identify, and manage risks from vulnerabilities and assess cybersecurity threats. The Company’s process for identifying and assessing material risks from cybersecurity threats operates alongside the importanceCompany’s broader overall risk assessment process. Senior management meets regularly with the Company’s risk-management team and understandinginternal and external auditors to evaluate the effectiveness of their rolethe Company’s systems, controls, and management processes with respect to cybersecurity risks. The results of key assessments are reported in protecting their identitiessummary to the Board periodically. To minimize the risks and the privacy of their information. We consider customer education regardingvulnerabilities from the use of electronic convenience products to be especially important due to the Bank’s increased exposure to loss related to these products if procedures are not followed. A Vendor Management Policythird-party service providers, a vendor management policy is in place, which is approved by the Bank’s Board of Directors annually. The Vendor Management Policyvendor management policy calls for the assignment of levelsevaluation of risk tofor each vendor based upon an assessment of the degree to which their relationship could expose the Company to risk in relation to the Company’s reliance on the vendor’s promise to perform and to protect customer privacy and based on the vendor’s fiscal strength.

The Company provides mandatory initial and annual training thereafter for personnel regarding security awareness as a means to equip the Company’s personnel with the understanding of how to properly use and protect the computing resources entrusted to them, and to communicate the Company’s information security policies, standards, processes and practices. We also work to educate our customers about the importance and understanding of their role in protecting their identities and the privacy of their information.We consider customer education regarding the use of electronic convenience products to be especially important due to the Bank’s increased exposure to loss related to these products if procedures are not followed.

Audit Committee

The primary functions of the Audit Committee, which met sevenfive times in 2022,2023, include reviewing and approving the services of the independent registered public accounting firm; reviewing the Company’s financial statements; review of the Company's processes and procedures in place for maintaining the Company’s compliance with Section 404 of the Sarbanes-Oxley Act of 2002 ("SOX") as evaluated by the Company’s internal audit manager, internal SOX Committee, and the Company's independent registered public accounting firm, reviewing the plan, scope, and audit results of the internal and external auditors; reviewing the reports of regulatory authorities; reviewing controls related to cybersecurity risk disclosures; and, reviewing and overseeing the Company's external reporting on environmental, social and governance related matters. The Board has adopted a

written charter for the Audit Committee. A copy of the Audit Committee charter is attached to this proxy statement as Exhibit A. Members of the Audit Committee in 20222023 were Mr. David J. McCambridge, Ms. Linda C. Thomas, and Mr. David G. Wight. Mr. McCambridge was appointed to the Committee in 2011, Ms. Thomas was appointed in 2016, and Mr. Wight was appointed in 2007.2007 and left the Audit Committee in January 2024 concurrent with his resignation from the Board. Mr. John C.

Swalling was appointed to the Audit Committee in March of 2024. Mr. McCambridge has been the Chair of the Audit Committee since 2017. The Board has determined that each of the members of the Audit Committee are independent directors within the meaning of the Securities and Exchange Commission rules applying to Audit Committee members and the Nasdaq Global Select Market listing standards. The Audit Committee and the Board have also determined that Mr. McCambridge qualifies as an Audit Committee financial expert within the meaning of such rules.

Compensation Committee

The primary functions of the Compensation Committee, which met three times in 2022,2023, are: to review and approve Executive and all Senior Vice President compensation; to select and approve employee benefits and retirement plans; to review and approve the Company’s compensation recovery policy and stock incentive and profit sharing plans; and, to oversee environmental, social and governance matters related to human resource management including review of the effectiveness and continuous improvement of the Company's strategies and practices regarding its human resources management function including total rewards, corporate culture, human capital and talent management, management succession, and diversity and inclusion practices. The Board has adopted a written charter for the Compensation Committee. A copy of the Compensation Committee charter is attached to this proxy statement as Exhibit B. Compensation Committee members arein 2023 were Mr. Karl L. Hanneman, Mr. David J. McCambridge, Mr. Anthony J. Drabek, Ms. Krystal M. Nelson, and Mr. John C. Swalling. Mr. Hanneman was appointed to the Compensation Committee in 2014, Mr. McCambridge was appointed in 2011 and served on the Compensation Committee through May of 2023, Ms. Nelson was appointed in 2015, and Mr. Swalling was appointed in 2005.2005, and Mr. Drabek was appointed in May of 2023. Ms. Nelson has been the Chair of the Compensation Committee since 2017. In March of 2024, Mr. John C. Swalling left the Compensation Committee incident to his appointment to the Audit Committee and Ms. Marilyn F. Romano was appointed to the Compensation Committee. All members of the Compensation Committee have been determined by the Board to be independent directors within the meaning of currently applicable rules of the Securities and Exchange Commission and the Nasdaq Global Select Market listing requirements.

Governance and Nominating Committee

The primary functions of the Governance and Nominating Committee, which met four times in 2022,2023, are to evaluate the size, compensation, and composition of the Board; to develop criteria for Board membership; to identify, recruit, interview, and evaluate individuals qualified to become Board members; to evaluate the independence of existing and prospective directors; to periodically review and reassess the Company's cybersecurity oversight framework and initiatives;ethics report from the Internal Audit Department; and, to review the Company's practices that relate to matters of environmental, social and governance framework initiatives. A copy of the Governance and Nominating Committee charter is attached to this proxy statement as Exhibit C. With respect to nomination of director candidates, the Governance and Nominating Committee will consider nominations from the Company’s shareholders using the same criteria as for all other nominations. Shareholder nominations must be made in writing and delivered or mailed to the Corporate Secretary no later than one-hundred-twenty days prior to the anniversary date of the immediately preceding annual meeting of shareholders of the Company. Any nomination not made in accordance with the Bylaws and the requirements of Rule 14a-19 of the 1934 Act may be disregarded at the discretion of the Chair of the Annual Meeting.

Additionally, the Governance and Nominating Committee recommends appointments of directors to the Board’s Committees, reviews and approves the related party nature of all related party transactions, and reviews the adequacy of the Company’s Corporate Governance Guidelines, the Company's environmental, social and governance framework and initiatives, and the Company’s Code of Business Conduct and Ethics and recommends any proposed changes to the Board for approval. Current members of the Governance and Nominating Committee are Mr. David W. Karp, Mr. Joseph P. Marushack, Mr. John C. Swalling, and Ms. Linda C. Thomas. Mr. Karp was appointed to the Governance and Nominating Committee in 2015, Mr. Marushack was appointed in 2022, Mr. Swalling was appointed in 2011, and Ms. Thomas was appointed in 2014. Mr. Swalling is the Chair of the Governance and Nominating Committee. All of the members of the Governance and Nominating Committee are considered by the Board to be independent directors within the meaning of currently applicable rules of the Securities and Exchange Commission and the Nasdaq Global Select Market listing requirements.

Director Nomination Criteria

The Governance and Nominating Committee believes that certain criteria should be met by director nominees to ensure effective corporate governance of the Company. Qualified candidates are those who, in the judgment of the Governance and Nominating Committee, possess certain personal attributes, a diversity of ideas and viewpoints, and a sufficient mix of experience and related attributes to assure effective service on the Board. The personal attributes of director nominees that the Governance and Nominating Committee considers include:

● Integrity. Each candidate shall be an individual who has demonstrated integrity, honesty, fairness, responsibility, good judgment, and ethics in his or her personal and professional life and has established a record of professional accomplishment in his or her chosen field.

● Leadership. Each candidate should be or have been in a generally recognized position of leadership in the candidate’s field of endeavors.

● Independence. No candidate, or family member (as defined in Nasdaq Global Select Market listing rules) or affiliate or associate (as defined in federal securities laws) of a candidate, shall have any material personal, financial or professional interest in any present or potential competitor of the Company.

● Active Participation. Each candidate must be prepared to participate fully in Board activities, attendance at, and active participation in, meetings of the Board and the committee(s) of which they are a member, and not have other personal or professional commitments that would, in the Governance and Nominating Committee's sole judgment, interfere with or limit their ability to do so.

● Best Interests of All Shareholders. Each candidate must be prepared to represent the best interests of all the Company’s shareholders and be willing to state their independent opinions in a constructive manner.

● Collegiality. Each candidate should be able to work well with other directors and executives of the Company.

● Diversity. Each candidate's background, qualifications and personal characteristics and the candidate's impact on the diversity of the Board's composition in terms of age, skills, gender, race and other factors relevant to the Company's business.

The Governance and Nominating Committee will consider and evaluate all candidates identified through the processes described above, including incumbents and candidates proposed by the Company’s shareholders. After consideration, the Governance and Nominating Committee will finalize its list of recommended candidates for the Board's consideration. Candidates who are then approved by the Board are included in the recommended slate of director nominees in the Company's proxy statement.

Director Experience, Tenure, Diversity and Refreshment

The Board maintains a unique balance of experience, tenure, diversity, cultural and local market knowledge and broad subject matter expertise. While our longer-tenured directors carry a wealth of experience and deep understanding of the Company and our industry, the Board embraces the need for fresh perspectives and is committed to continued director refreshment.

The Board's refreshment activities are ongoing. Since 2014, the Board added eight new directors including one in 2023, one in 2021, and one in 2018.2018 and Mr. Huston is nominated as a new director at the Annual Meeting. One long-serving director resigned from the Board in January 2024 and another long-serving director will not be nominated for re-election at the Annual Meeting.

The Board employs a balanced approach to populatingappointing Board committees. We believe this refreshment strategy results in a membership that maintains new and contemporary perspectives, ideas and approaches.

Board and Committee Evaluations

The Governance and Nominating Committee leads and oversees the annual evaluation of the Board and Board committees, including an annual individual director self-assessment. Additionally, there is a biannual independent third party hosted survey to determine whether the Board and its committees are functioning effectively. The Governance and Nominating Committee establishes the evaluation criteria, oversees the evaluation process, discusses the results with the Board, and implements any changes that emerge from the evaluations that the Board deems appropriate to enhance Board effectiveness.

An independent consultant provides assistance with the design of the online survey instrument and administers the survey on behalf of the Governance and Nominating Committee, thereby assuring anonymity of participant responses through a secure,

encrypted website. A written report of total Board data, as well as data for the Board committees, is prepared by the consultant, analyzing the closed-end questions and including the verbatim comments offered by directors at the close of each section of the survey that may provide recommendations for improvement. The report also tracks current data against results from previous surveys, where comparable.

Director Compensation

In 2022,2023, all non-officer directors who did not serve as a committee chair received a $30,000 annual cash retainer. Annual cash retainers of $42,500, $36,000, and $35,000 were paid to the independent lead director and Chair of the Governance and Nominating Committee, the non-officer Chair of the Audit Committee, and the non-officer Chair of the Compensation Committee, respectively, in 2022.2023. All non-officer directors received an additional $25,000 in cash to be used for the purchase of the Company’s common stock on the open market following the 20222023 Annual Meeting. Members of the Audit Committee receive $1,000 for each Audit Committee meeting attended and members of the Governance and Nominating, and Compensation Committees receive $850 for each committee meeting attended. For information as to specific amounts paid to each of our directors in 2022,2023, see "Director Compensation" in this proxy statement.

Compensation Committee Interlocks and Insider Participation

The following directors served as members of the Compensation Committee during 2022:2023: Mr. Hanneman, Mr. McCambridge, Ms. Nelson, Mr. Swalling, and Mr. Swalling.Drabek. No member of the Compensation Committee was, during the year ended December 31, 2022,2023, an officer, former officer, or employee of the Company or any of its subsidiaries, or had any relationship requiring disclosure by the Company under the Securities and Exchange Commission rules requiring disclosure of certain relationships and related party transactions. No executive officer of the Company served as a member of the compensation committee of another entity in which one of the executive officers of such entity served on the Company's Compensation Committee, the board of directors of another entity in which one of the executive officers of such entity served on the Company’s Compensation Committee, or the compensation committee of another entity in which one of the executive officers of such entity served as a member of the Board during the year ended December 31, 2022.2023.

Code of Conduct

The Company has adopted a Code of Conduct, which includes a Code of Ethics for all employees, including executive officers, and all of our non-employee directors. We will furnish a copy of the Code of Conduct to shareholders, at no charge, upon written request to the Corporate Secretary at P.O. Box 241489, Anchorage, AK 99524-1489.

The Code of Conduct addresses the professional, honest and ethical conduct required of each employee and director, conflicts of interest, disclosure process, compliance with laws, rules and regulations (including securities trading), corporate opportunities, confidentiality, fair dealing, protection and proper use of Company assets, and encourages the reporting of any illegal or unethical behavior through robust reporting protocols and whistleblower protections. A waiver of any provision of the Code of Conduct may be made only by the Company's Governance and Nominating Committee of the Board and must be promptly disclosed as required by SECcurrently applicable rules of the Securities and NASDAQ rules.Exchange Commission and the Nasdaq Global Select Market listing requirements. The Company will disclose any such waivers.

The Company’s management team develops the Company’s strategic direction and oversees its execution, while the Board is charged with providing guidance, insight and oversight as to the strategy, initiatives and management’s performance. As discussed elsewhere in this proxy statement, the Board and management also remain committed to fostering an effective and efficient risk and control environment that includes an emphasis on an ethically driven culture and an ongoing investment in our employees and community.

Prohibition against Hedging and Insider Trading Policy

Under the terms of the Company’s Insider Trading Policy, all Directors, officers (including, but not limited to, all our named executive officers) employees, and consultants, are prohibited from engaging in any hedging transaction involving shares of the Company’s securities, such as a put, call, other derivative securities, short sale or short-term trading. Our Directors, officers (including, but not limited to, all our named executive officers), employees, and consultants are also strongly discouraged from pledging any Company securities. The Insider Trading Policy also prohibits all Directors, officers (including, but not limited to, all our named executive officers) employees, and consultants from trading on the basis of material non-public information.

Compensation Recovery Policy

In 2023, the Company adopted a Compensation Recovery Policy. The Compensation Recovery Policy provides that if the Company is required to prepare a qualifying accounting restatement, the Company will, unless an exception applies, recover reasonably promptly the excess amount of erroneously awarded incentive-based compensation, whether cash or equity, provided to a covered executive over the amount that otherwise would have been received by the covered executive had such compensation been determined based on the restated financials, computed without regard to any taxes paid. This policy applies incentive-based compensation received by a covered executive on or after December 1, 2023.

The Compensation Recovery Policy was filed as Exhibit 97 to our Annual Report on Form 10-K for the year ended December 31, 2023.

Environmental, Social, Governance and Leadership Highlights

The Company is committed to promoting sound environmental, social, governance ("ESG") and effective leadership through strong Board leadership and management oversight of the Company’s processes. Broadly speaking, our senior management team develops the Company’s ESG strategic direction and oversees its execution while the Board, primarily through the Governance and Nominating Committee is charged with providing guidance, insight and oversight as to the strategy, initiatives and management’s performance. In addition, the Company’s Audit Committee and Compensation Committee also play significant oversight roles with respect to the external communications and human resources implementation elements, respectively, of the Company’s overall environmental, social and governanceESG initiatives.

Protecting and Preserving the Environment

Lending in compliance with all applicable environmental laws and regulations: When real property is involved in a lending transaction, whether used for a real estate business or as collateral for commercial and industrial lending, Northrimthe Bank is committed to complying with all applicable environmental laws and regulations. For example, before a lending transaction takes place, the bank receives a property questionnaire regarding current and historical compliance with environmental laws, including groundwater and/or soil contamination, the presence of asbestos, etc. Other inspections or tests may also be performed. The final lending documentation includes an environmental agreement obligating the borrower to comply with all applicable environmental laws and regulations, committing the borrower to cure any violations and notifying Northrimthe Bank should there be a breach.

Sustainability Master Plan Project: In 2023, the Bank received a building recommendation report on its main headquarters building in Anchorage, Alaska that encompassed Solar Power and other Green Building Modifications. The Bank is currently reviewing and assessing the recommendations to determine next steps of this project. The goal of the Sustainability Master Plan is to address revitalizing the aging infrastructure

of our 52-year old52-year-old headquarters building. Some of these projects encompass equipment replacement due to age, implementing energy efficiencies and renewable resources, and sustainability in the event of a catastrophic natural disaster. In 2022, Northrim engaged a contractor for design-build services for this long range building plan to encompass the following initial projects: Electrical Transformer Replacement, Cooling Tower Replacement, new Stand-by Generator, new Building Air Cleaning System, Solar Power and other Green Building Modifications, and an Exterior Façade Upgrade. Research & Planning was scheduled for Q1-Q4 2022 and based on budget and recommendations, implementation of projects is planned in 2023-2026.

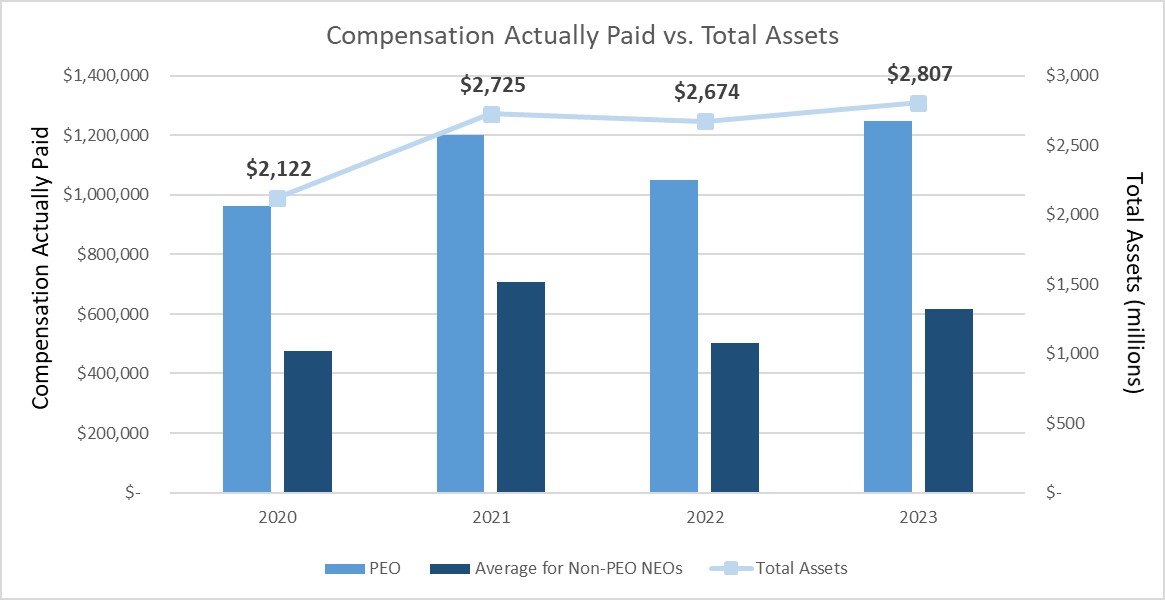

Financing the Clean Energy Transition: TransitionNorthrim: The Bank recognizes the risks created by climate change and we are working to be part of the solution. To accelerate the transition to clean energy, we have been actively engaged with the CommercialC-PACER program (Commercial Property Assessed Clean Energy ("C-PACE") program& Resilience) in Alaskan communities to drive energy improvements in local communities and create energy jobs. Working with a customer, national lender andcommunities. By facilitating the Municipalityfinancing of Anchorage, Northrim was part of the first C-PACE financing in Anchorage and Alaska. By financing energy improvements and renewable energy in Alaska, we are doing our part in accelerating the clean energy transition while building a greener, stronger community.